Fund IV: Building on a Decade of Success

Fund IV: Building on a Decade of Success

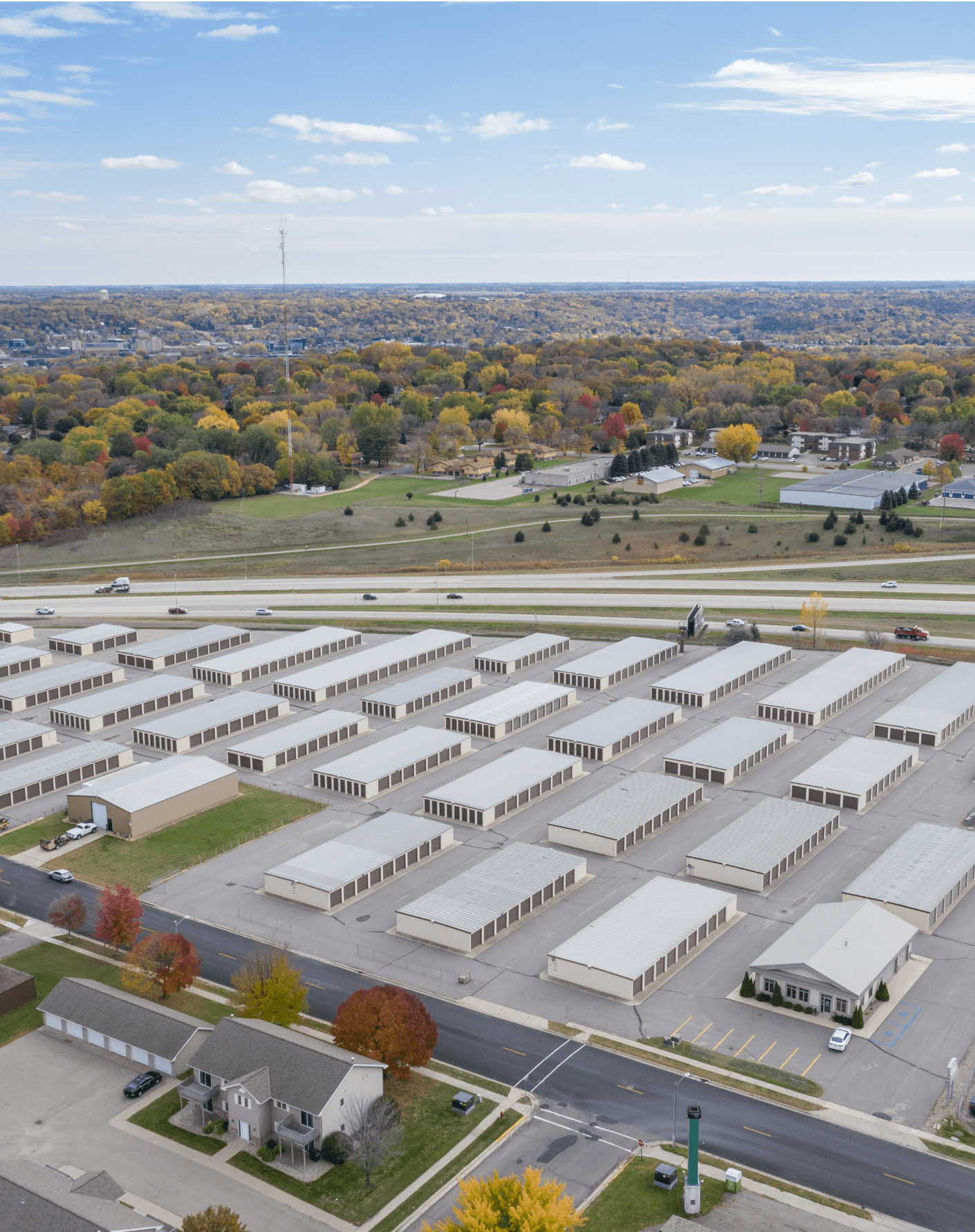

Crystal View Capital's Fund IV continues our proven strategy of investing in recession-resistant self-storage and manufactured housing communities. With a target raise of $200 million, Fund IV offers accredited investors the opportunity to participate for long-term wealth creation.

Crystal View Capital's Fund IV continues our proven strategy of investing in recession-resistant self-storage and manufactured housing communities. With a target raise of $200 million, Fund IV offers accredited investors the opportunity to participate for long-term wealth creation.

Fund Highlights

Fund Highlights

Fund Highlights

$200M

$200M

Target Size

Target Size

$50,000

$50,000

Minimum Investment

Minimum Investment

15-20% IRR

15-20% IRR

Target Return

Target Return

7-9%

7-9%

Preferred Return

Preferred Return

$1,050,000

$1,050,000

Manager Commitment

Manager Commitment

$300-400M

$300-400M

Portfolio Size

Portfolio Size

Quarterly

Quarterly

Distribution Terms

Distribution Terms

~10 years

~10 years

Fund Duration

Fund Duration

Investment Thesis

Investment Thesis

Fund IV will leverage our established networks and expertise to:

Fund IV will leverage our established networks and expertise to:

Acquire undervalued self-storage and manufactured housing assets in strategic locations.

Implement our proven value-add strategies to enhance operations and increase profitability.

Capitalize on the growing demand for affordable storage solutions and housing options.

Generate stable cash flows with potential for significant appreciation upon exit

Acquire undervalued self-storage and manufactured housing assets in strategic locations.

Implement our proven value-add strategies to enhance operations and increase profitability.

Capitalize on the growing demand for affordable storage solutions and housing options.

Generate stable cash flows with potential for significant appreciation upon exit

Long-Term Thesis

Long-Term Thesis

Acquisition Opportunity

Acquisition Opportunity

Over $100 million in specific targets identified, with a focus on off-market deals from retiring "mom and pop" owners.

Over $100 million in specific targets identified, with a focus on off-market deals from retiring "mom and pop" owners.

Demand for Affordability

Demand for Affordability

Addressing the US housing affordability crisis through manufactured housing communities.

Addressing the US housing affordability crisis through manufactured housing communities.

Institutional Appeal

Institutional Appeal

Potential for significant portfolio aggregation and eventual sale to large institutions.

Potential for significant portfolio aggregation and eventual sale to large institutions.

Current Fund IV Portfolio

Current Fund IV Portfolio

As of August 2024, Fund IV has already acquired a strong portfolio of assets:

As of August 2024, Fund IV has already acquired a strong portfolio of assets:

As of August 2024, Fund IV has already acquired a strong portfolio of assets:

17

17

Total Assets

Total Assets

2,197

2,197

Storage Units (256,257 rentable sq ft)

Storage Units (256,257 rentable sq ft)

1,086

1,086

Manufactured Housing Community Sites

Manufactured Housing Community Sites

$56 M

$56 M

Assets Under Management

Assets Under Management

Why Invest Now?

Why Invest Now?

Proven Track Record

Proven Track Record

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Recession-Resistant Focus

Recession-Resistant Focus

Our chosen sectors have demonstrated resilience through economic cycles.

Our chosen sectors have demonstrated resilience through economic cycles.

Vertical Integration

Vertical Integration

Full control from acquisition to management, ensuring operational excellence

Full control from acquisition to management, ensuring operational excellence

Off-Market Advantage

Off-Market Advantage

92% of our deals are sourced off-market, providing unique opportunities

92% of our deals are sourced off-market, providing unique opportunities

How to Invest

How to Invest

Proven Track Record

Proven Track Record

Proven Track Record

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Our previous funds have demonstrated strong performance, producing a 30% average IRR accross all funds.

Recession-Resistant Focus

Recession-Resistant Focus

Recession-Resistant Focus

Our chosen sectors have demonstrated resilience through economic cycles.

Our chosen sectors have demonstrated resilience through economic cycles.

Our chosen sectors have demonstrated resilience through economic cycles.

Vertical Integration

Vertical Integration

Vertical Integration

Full control from acquisition to management, ensuring operational excellence

Full control from acquisition to management, ensuring operational excellence

Full control from acquisition to management, ensuring operational excellence

Off-Market Advantage

Off-Market Advantage

Off-Market Advantage

92% of our deals are sourced off-market, providing unique opportunities

92% of our deals are sourced off-market, providing unique opportunities

92% of our deals are sourced off-market, providing unique opportunities

Subscribe for A Clear Perspective

Crystal View Capital's monthly newsletter keeping you informed on our latest insights and opportunities

Address

9515 Hillwood Drive, Las Vegas, NV 89134

This website is neither an offer to sell nor a solicitation of an offer to buy any securities. Any offer or solicitation will be made only by the offer’s offering memorandum (a Private Placement Memorandum “PPM”). You should not rely on any information other than the information in the PPM when considering an investment. Should you have any questions, please reach out to us at invest@crystalviewcapital.com

Subscribe for A Clear Perspective

Crystal View Capital's monthly newsletter keeping you informed on our latest insights and opportunities

Address

9515 Hillwood Drive, Las Vegas, NV 89134

This website is neither an offer to sell nor a solicitation of an offer to buy any securities. Any offer or solicitation will be made only by the offer’s offering memorandum (a Private Placement Memorandum “PPM”). You should not rely on any information other than the information in the PPM when considering an investment. Should you have any questions, please reach out to us at invest@crystalviewcapital.com

Subscribe for A Clear Perspective

Crystal View Capital's monthly newsletter keeping you informed on our latest insights and opportunities

Address

9515 Hillwood Drive, Las Vegas, NV 89134

This website is neither an offer to sell nor a solicitation of an offer to buy any securities. Any offer or solicitation will be made only by the offer’s offering memorandum (a Private Placement Memorandum “PPM”). You should not rely on any information other than the information in the PPM when considering an investment. Should you have any questions, please reach out to us at invest@crystalviewcapital.com